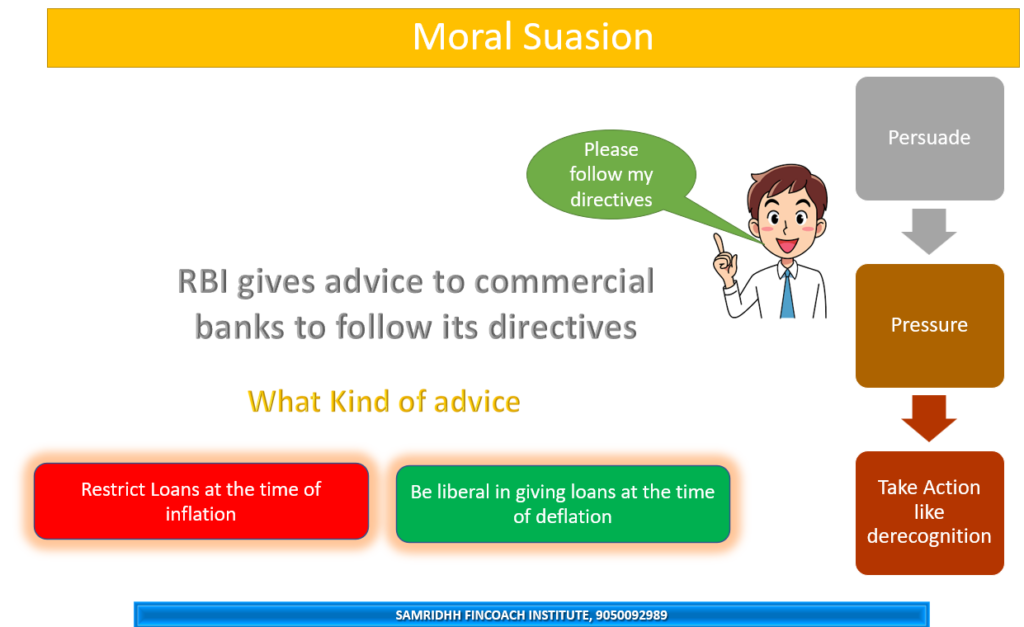

Moral suasion as a qualitative instrument of credit control is a method used by the central bank to influence the lending behaviour of commercial banks and other financial institutions by using its moral authority and persuasive power, rather than legal or regulatory means. Moral suasion involves the central bank issuing advice, suggestions, requests and appeals to the commercial banks to cooperate with its monetary policy objectives and to follow certain norms and guidelines in their credit operations.

Moral suasion can be used by the central bank to achieve various goals, such as:

- To restrain or expand the overall credit creation in the economy, depending on the economic conditions and the inflation or deflation situation.

- To direct the credit flow to certain priority sectors or industries that are considered socially or economically desirable, and to discourage the credit flow to certain non-priority or speculative sectors or industries that are considered harmful or risky.

- To maintain the stability and soundness of the banking system and to prevent any financial crisis or contagion.

- To enhance the confidence and trust of the public and the market participants in the central bank’s policies and actions.

Moral suasion can be applied in public as well as in private. The central bank can use public statements, speeches, press releases, reports, publications, etc., to communicate its views and expectations to the commercial banks and the general public. The central bank can also use private meetings, discussions, letters, phone calls, etc., to convey its specific requests and recommendations to individual commercial banks or groups of banks.

Moral suasion is not a statutory obligation or a legal compulsion for the commercial banks. It is based on the voluntary cooperation and compliance of the commercial banks with the central bank’s wishes. Therefore, the effectiveness of moral suasion depends on various factors, such as:

- The credibility and reputation of the central bank as a monetary authority and a regulator.

- The degree of alignment or divergence between the central bank’s objectives and the commercial banks’ interests and incentives.

- The presence or absence of implicit or explicit threats or rewards by the central bank for following or not following its moral suasion.

- The availability or unavailability of alternative sources of funds or markets for the commercial banks.

- The level of competition or cooperation among the commercial banks.

Here are some examples of how moral suasion has been used by central banks as a qualitative instrument of credit control:

- In India, the Reserve Bank of India (RBI) has used moral suasion extensively to regulate the credit creation and allocation by commercial banks. One of the areas where the RBI used moral suasion to a significant extent was in the implementation of the National Credit Plan (NCP) under which the Banks’ annual monetary program was combined with a diversion of commercial bank credit to pre-determined priority areas