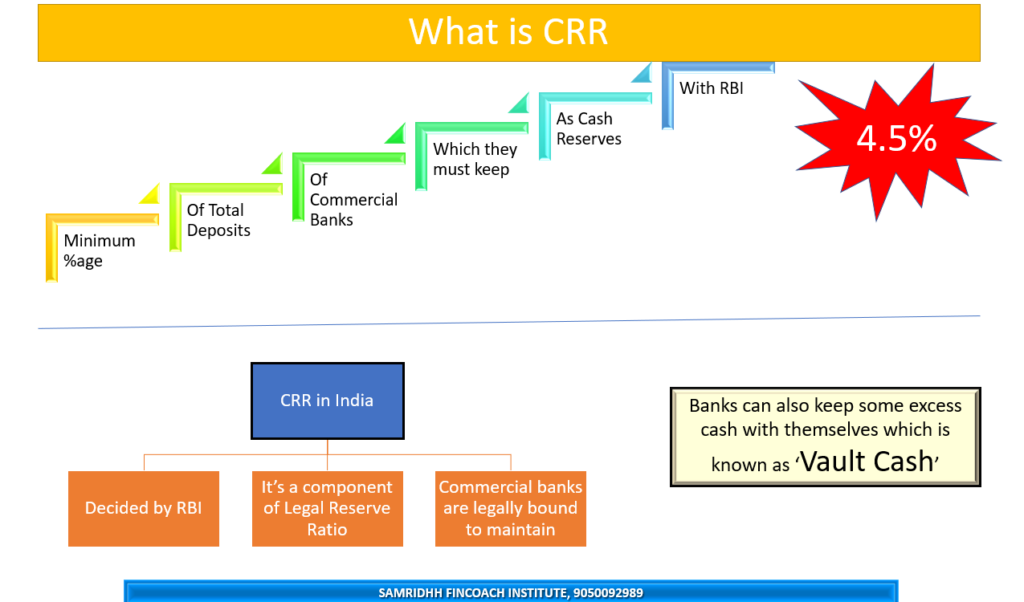

Cash reserve ratio (CRR) is the percentage of total deposits that commercial banks have to keep as cash reserves with the central bank of their country. For example, in India, the central bank is the Reserve Bank of India (RBI), and the current CRR is 4.5%. This means that for every 100 rupees deposited in a bank, the bank has to keep Rs 4.5 rupees with the RBI and can use the remaining Rs 95.5 rupees for lending or investment purposes.

The main objective of CRR is to control the money supply in the economy and ensure the stability of the banking system. By changing the CRR, the central bank can influence the liquidity and interest rates in the market. For instance, if the central bank increases the CRR, it means that banks have to keep more money with the central bank and have less money to lend or invest. This reduces the money supply which in turn increases the interest rates, which can help to reduce inflation and credit growth. On the other hand, if the central bank decreases the CRR, it means that banks have to keep less money with the central bank and have more money to lend or invest. This increases the money supply and decreases the interest rates, which can help to stimulate economic activity and growth.

Let us take an example to understand how CRR works. Suppose there are two banks, A and B, in an economy. The total deposits of both banks are 1000 crores each, and the CRR is 5%. This means that both banks have to keep 50 crores each with the central bank as cash reserves. Now, suppose the central bank reduces the CRR to 4%. This means that both banks now have to keep only 40 crores each with the central bank as cash reserves. The excess cash remaining due to reduction in CRR can be used by both banks for lending or investment purposes. This increases the money supply in the economy by 20 crores (10 crores x 2 banks) and lowers the interest rates, which can boost economic activity and growth.