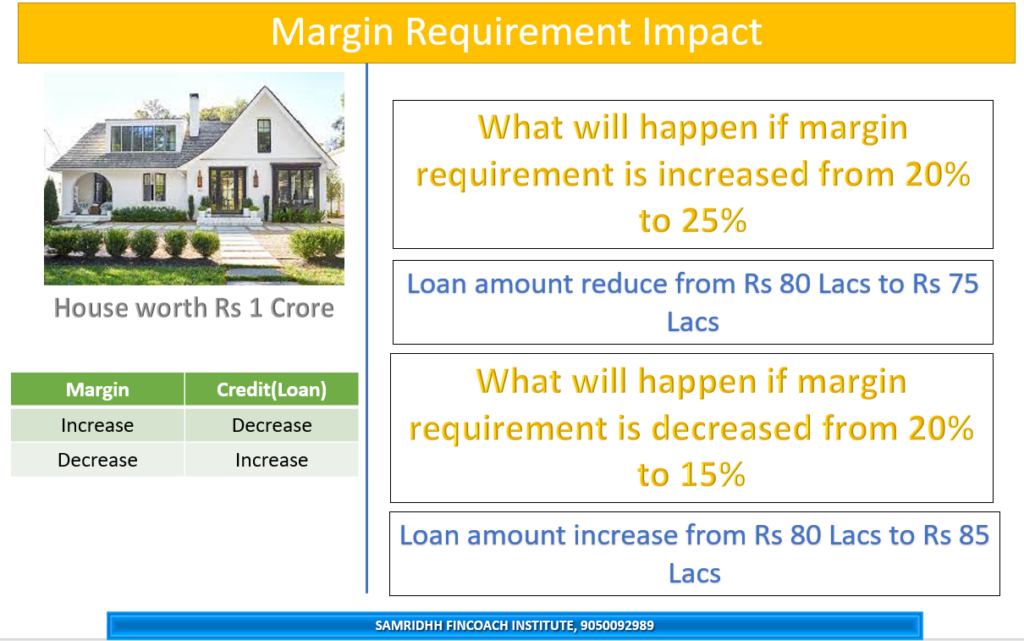

Margin requirements refer to the difference between the current value of the security offered for loan (called collateral) and the value of loan granted. For example, mortgaging land for Rs 100 lakh with the bank for a loan of Rs 75 lakh would have a margin requirement of Rs 25 lakh.

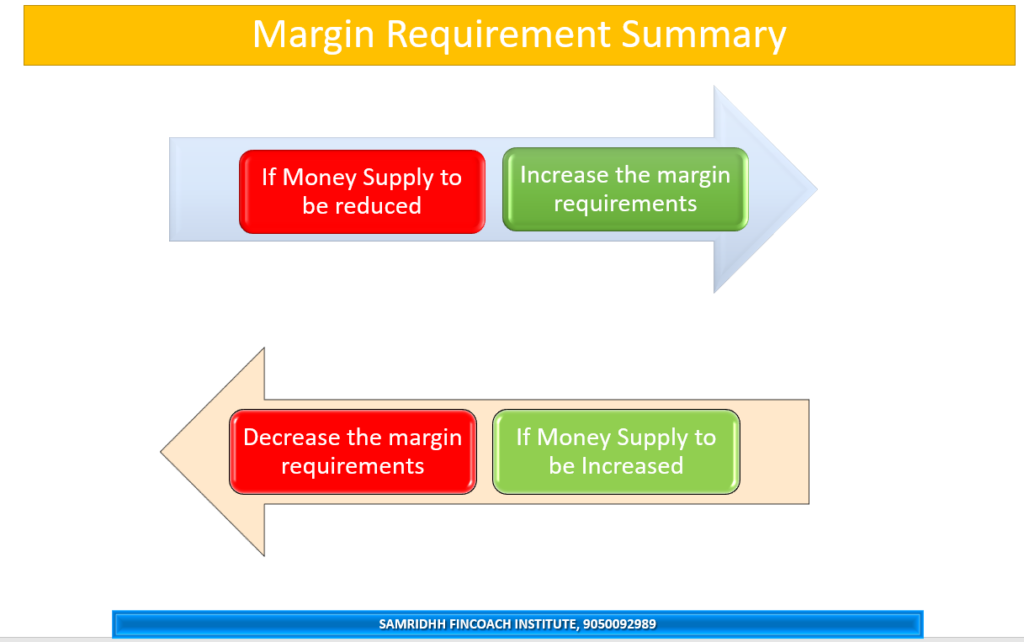

Margin requirements are a qualitative method of credit control adopted by the central bank to stabilize the economy from inflation or deflation. By changing the margin requirements, the central bank can influence the availability and cost of credit in the economy. For instance, if the central bank increases the margin requirements, it means that the borrowers will have to offer more collateral or security for the same amount of loan. This will reduce the demand for credit and lower the money supply in the economy. Conversely, if the central bank decreases the margin requirements, it means that the borrowers will have to offer less collateral or security for the same amount of loan. This will increase the demand for credit and raise the money supply in the economy.

Here are some examples of how margin requirements can be used to control credit creation:

- Suppose the central bank wants to curb inflation in the economy. It can increase the margin requirements for loans against certain securities, such as gold, stocks, bonds, etc. This will make it more difficult and expensive for borrowers to obtain loans against these securities. As a result, the demand for credit and money supply will decrease, leading to lower inflation.

- Suppose the central bank wants to stimulate economic growth in the economy. It can decrease the margin requirements for loans against certain securities, such as agricultural produce, machinery, equipment, etc. This will make it easier and cheaper for borrowers to obtain loans against these securities. As a result, the demand for credit and money supply will increase, leading to higher economic activity.

- Suppose the central bank wants to promote certain sectors or industries in the economy. It can vary the margin requirements for loans against different types of securities, depending on their social or economic importance. For example, it can lower the margin requirements for loans against securities related to education, health care, renewable energy, etc., and raise the margin requirements for loans against securities related to luxury goods, gambling, tobacco, etc. This will encourage more credit flow to the desired sectors or industries and discourage credit flow to the undesired sectors or industries.