The measurements of money supply can be classified into Broad money supply and Narrow money supply. But to understand this first we have to understand the meaning of liquidity of money

Liquidity of Money

Liquidity refers to the efficiency or ease with which an asset or security can be converted into ready cash without affecting its market price. The most liquid asset of all is cash itself. The higher the liquidity of an asset the more easy it is to convert in into cash

An easy way to understand the concept of liquidity of money is to think of different types of money as different types of water. For example:

- Cash is like liquid water. It is the most liquid form of money, it is already in the form of cash

- Bank deposits are like ice cubes. They are still liquid, but not as much as cash. It takes a little while (may be few hours) and effort to convert them into ready cash.

- Bonds are like frozen water. They are less liquid than cash or bank deposits, because these takes more time (may be 2-3 days) to convert them into cash. There may be some costs or risks involved in selling bonds, such as transaction fees, price fluctuations, or default risk. Bonds may also lose value due to changes in interest rates or inflation.

- Buildings are like icebergs. They are very illiquid, as selling them and converting them into cash may take many days to find a buyer and finalizing the deal and getting paid in cash

Broad and Narrow money supply

Narrow money supply concepts and broad money supply concepts are different ways of measuring the amount of money available in an economy. They differ in the types of money they include and the degree of liquidity they represent.

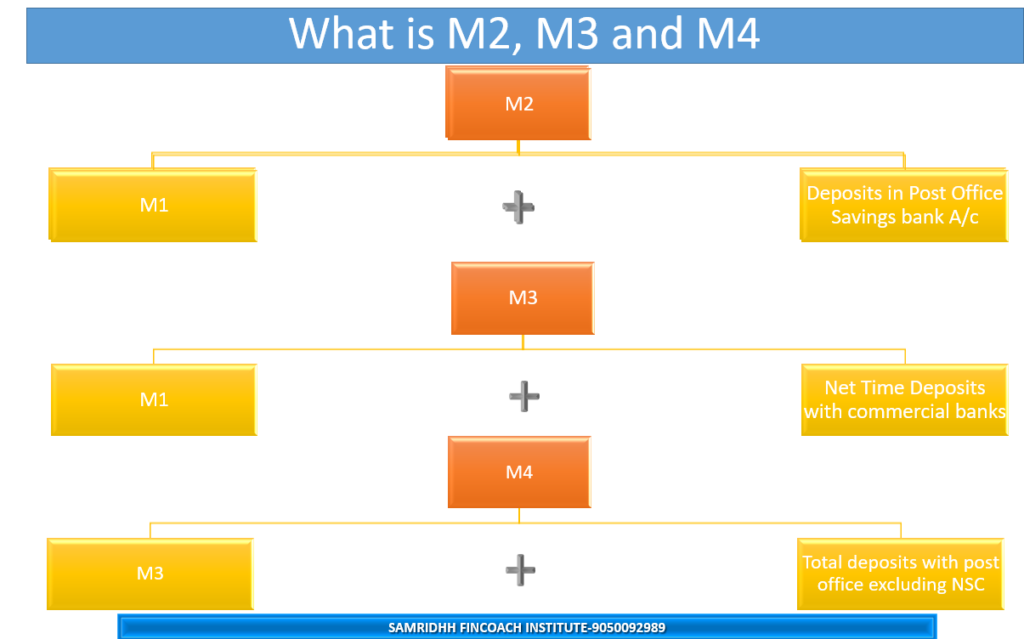

Narrow money supply concepts are those that include only the most liquid forms of money, such as currency in circulation and bank deposits that can be easily accessed and used for transactions. The most common narrow money supply concepts are M1 and M2.

Broad money supply concepts are those that include not only the narrow money supply concepts, but also other forms of money that are less liquid, such as time deposits. The most common broad money supply concepts are M3 and M4.

The main difference between narrow money supply concepts and broad money supply concepts is that narrow money supply concepts reflect the immediate purchasing power of money, while broad money supply concepts reflect the potential purchasing power of money. Narrow money supply concepts are more relevant for short-term economic analysis, such as inflation, interest rates, and exchange rates. Broad money supply concepts are more relevant for long-term economic analysis, such as economic growth, productivity, and financial stability.