There are two different concepts. First is stock of money and second is supply of money. And both are very much different. Lets first understand the stock of money.

Stock of money includes the amount of money held by

a) consumers of money i.e. people of the country and

b) Suppliers/Producers of money i.e. Government and Banking System (Central bank of the country and commercial banks)

Now out of the total stock of money only the money held by the consumers of money is considered as supply of money. The same can be understood with the help of following diagram :

Supply of money is a term that refers to the total amount of money available in an economy held by the consumers of money i.e. people of the country (both individuals and businesses). Supply of money is the stock concept. It excludes money held by government, commercial banks and reserve bank of India as they are themselves suppliers of money. Money supply can be measured in different ways, depending on what kinds of money are included. Some common measures of money supply are M1, M2, M3 and M4.

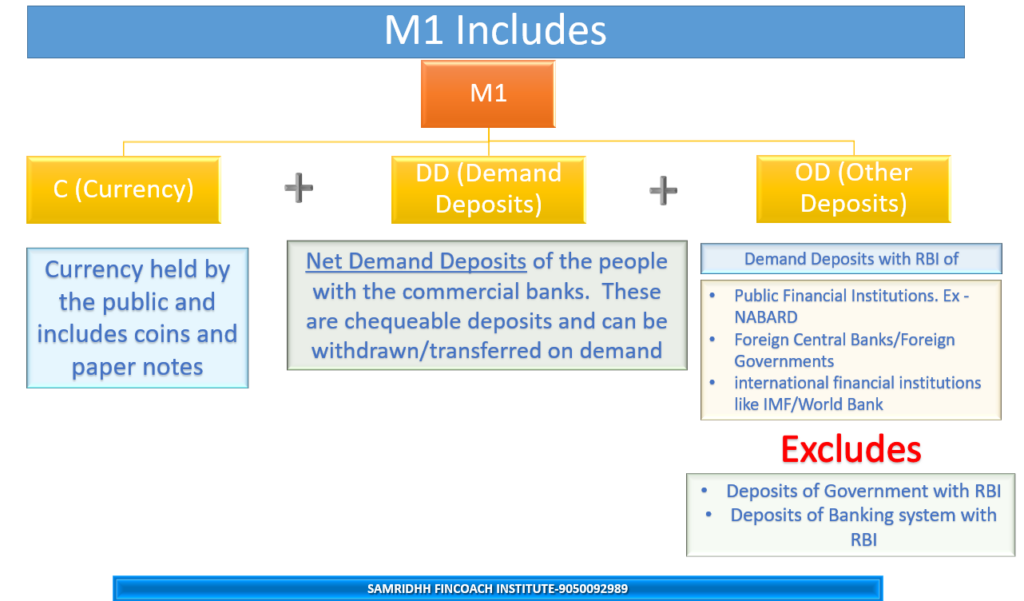

The most common measure of money supply is M1. M1 includes

- Currency held by public (Both coins and notes),

- Net Demand Deposits of the people with commercial banks

- Other deposits. This includes deposits with Reserve Bank of India of foreign central banks, foreign governments, International financial institutions and Public financial institutions in India. It excludes the deposits of Indian Government and Indian commercial banks (Both are suppliers of money) with the Reserve bank of India

Net Demand Deposits includes only the demand deposits of the public with commercial banks and excludes the inter banking claims which are basically the deposits of one commercial bank with another commercial bank.

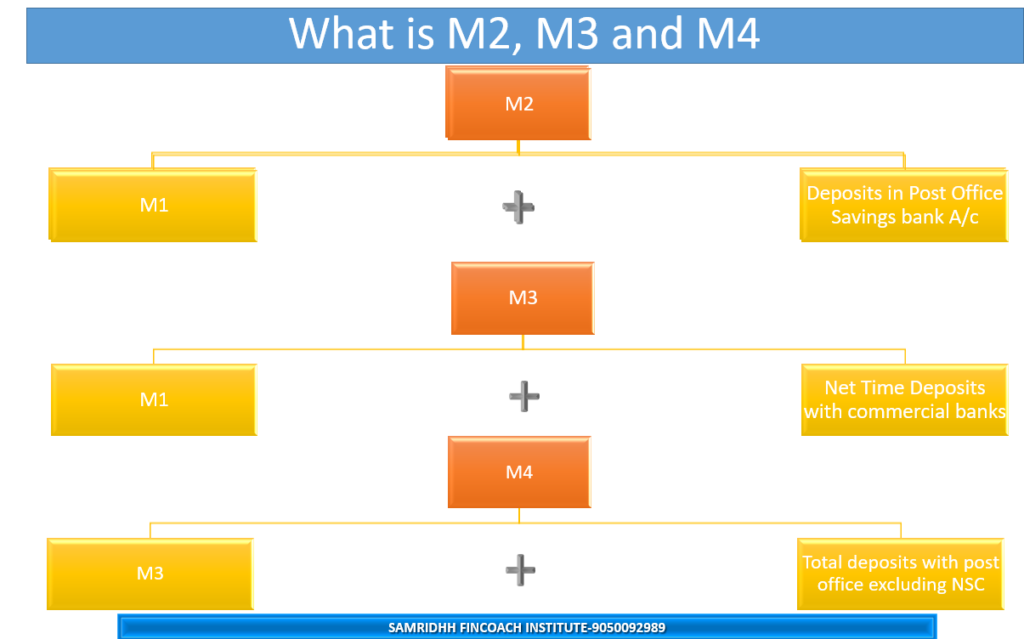

Next measure of money supply are M2, M3 and M4 which can be understood by the following diagram

The money supply is influenced by various factors, such as the monetary policy of the central bank, the banking system, the fiscal policy of the government, and the economic activity of the public. The central bank can increase or decrease the money supply by changing the interest rate it charges to banks for borrowing or lending money, by buying or selling government bonds or other securities in the open market, or by changing the reserve requirements for banks. The government can affect the money supply by changing its spending or taxation levels, by issuing or retiring debt, or by printing or minting new currency5. The public can influence the money supply by changing their preferences for holding cash or deposits, by saving or spending their income, or by investing or borrowing money.

The changes in the money supply have various effects on the economy. Generally speaking, an increase in the money supply tends to lower interest rates, stimulate economic growth, and cause inflation. A decrease in the money supply tends to raise interest rates, slow down economic growth, and cause deflation. However, these effects depend on many other factors, such as the demand for money, the velocity of money, the expectations of people, and the structure of the economy.

Some examples of how changes in the money supply have affected different economies are:

- In 1923, Germany experienced a hyperinflation due to a massive increase in the money supply caused by printing money to pay for war reparations after World War I. The prices rose so high that people had to use wheelbarrows to carry their cash and buy basic goods. The value of the German mark fell from 4.2 per US dollar in 1914 to 4.2 trillion per US dollar in 1923.

- In 2008-2009, the United States faced a financial crisis due to a collapse of the housing market and a freeze of credit markets. The Federal Reserve responded by increasing the money supply through a series of unconventional measures known as quantitative easing (QE). The Fed bought large amounts of mortgage-backed securities and other assets from banks and other financial institutions to inject liquidity into the system and lower interest rates. The Fed’s balance sheet expanded from about $900 billion in 2007 to about $4.5 trillion in 2014.

- In 2016-2017, India implemented a demonetization policy that invalidated 86% of its currency notes in circulation. The government claimed that this was done to curb corruption, black money, and terrorism financing. However, this caused a severe cash shortage and disrupted economic activity across sectors. Many people had to queue up for hours at banks and ATMs to exchange their old notes for new ones or deposit them into their accounts. The GDP growth rate fell from 8% in 2015-2016 to 6.7% in 2016-2017.