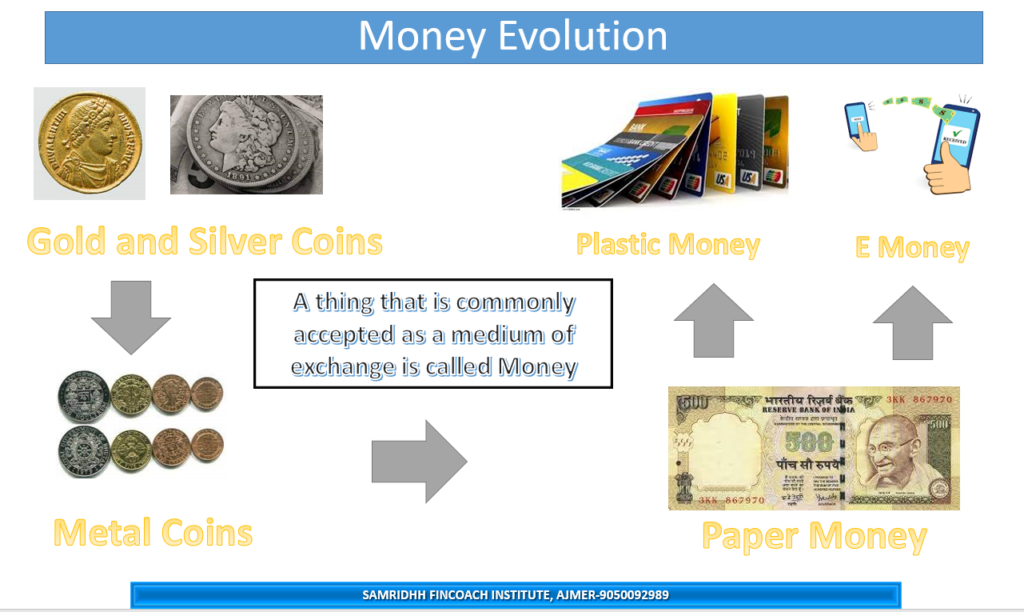

Money was not always the same as we see it today. It has taken many years of innovations to reach the present form of money. Here is a brief overview of the main stages of money development:

- Coinage: This was the earliest form of money, where people used standardized and stamped pieces of metal as a medium of exchange. Coins were issued by governments or authorities that guaranteed their weight and purity. Coins had some benefits over metal money, such as convenience, security, acceptability, and stability. However, coins also had some limitations, such as the cost of minting and transporting coins, the possibility of clipping and shaving coins, and the inflexibility of coin supply. Additionally the metal money was very bulky and was difficult to carry in large quantities

- Paper money: Due to the bulkiness of metal money, paper money came into use. In this form of money, people used paper notes or bills as a medium of exchange. Paper money was initially backed by gold or silver reserves or by government promises. Paper money had some advantages over coinage, such as lightness, ease of handling and printing, adaptability to changing economic conditions, and stimulation of trade and commerce. However, paper money also had some disadvantages, such as inflationary risks due to over-issuance or loss of confidence, counterfeiting risks due to forgery or duplication, and environmental impacts due to paper consumption and waste.

- Bank money: In this form of money, people used bank deposits or accounts as a medium of exchange. Bank money was created by banks through lending and fractional reserve banking. Bank money had some benefits over paper money, such as convenience, safety, efficiency, and innovation. However, bank money also had some drawbacks, such as dependence on banking systems and regulations, vulnerability to bank runs and crises, and complexity and opacity of financial transactions.

- Plastic money: This is a term that refers to credit cards, debit cards, and prepaid cards that can be used to make payments without using cash or checks. Plastic money is issued by banks or financial institutions that authorize and process the transactions. Plastic money has some benefits, such as convenience, security, rewards, and credit availability. However, plastic money also has some drawbacks, such as fees, interest, fraud, and overspending.

- Online banking: This is a service that allows customers to access and manage their bank accounts through the internet. Online banking enables customers to perform various functions, such as checking balances, transferring funds, paying bills, applying for loans, etc. Online banking has some advantages, such as convenience, speed, efficiency, and accessibility. However, online banking also has some risks, such as hacking, phishing, identity theft, and technical glitches.

- UPI apps: UPI stands for Unified Payments Interface, which is a system that enables instant and seamless transfer of money between different bank accounts using a mobile app. UPI apps like PayTM, GPay, PhonePe, etc., allow users to send and receive money using a virtual payment address (VPA) or a QR code. UPI apps have some benefits, such as simplicity, low cost, interoperability, and security. However, UPI apps also have some challenges, such as network dependency, user awareness and hacking.

- E-money is a term that refers to electronic money that is stored and transferred electronically through various devices and platforms. E-money can be issued by banks or other entities, and can be backed by fiat currency or other assets. E-money can take different forms, such as prepaid cards, online wallets, mobile wallets, contactless cards, etc. E-money has some benefits, such as convenience, safety, efficiency, and accessibility. However, e-money also has some risks, such as hacking, phishing, identity theft, and technical glitches

- Cryptocurrency: Itis a type of digital money that uses cryptography to secure and verify transactions, and to control the creation of new units. Cryptocurrencies operate on decentralized networks of computers, without the need for a central authority like a government or a bank. Some of the most popular cryptocurrencies are Bitcoin, Ethereum, Tether, Binance Coin, and XRP. Cryptocurrencies have some advantages, such as transparency, anonymity, security, and innovation. However, cryptocurrencies also have some challenges, such as volatility, scalability, legality, and adoption

- E-Rupee : India’s government is planning to introduce its own digital currency called e-Rupee. E-Rupee is a central bank digital currency (CBDC) that will be issued by the Reserve Bank of India (RBI). E-Rupee will be an electronic version of cash that will be primarily used for retail transactions. E-Rupee will be stored in a digital wallet that can be accessed through a mobile app or a card. E-Rupee will be denominated in Indian rupees and will have the same value as paper currency notes and coins. E-Rupee will have some advantages over cash, such as traceability, cost-effectiveness, speed, and inclusiveness. However, e-Rupee will also have some challenges, such as network dependency, user awareness, and regulatory compliance