Meaning of Capital

Meaning - In simplest terms , Capital means the amount that a person invests in business. This investment can be in any form be it cash or kind (Machinery, building, vehicle, stock, etc.).Considering that the business is a separate entity in accounting sese , the capital invested by the owner also becomes a liability for the business. This is the reason capital invested in business is shown on liability side of the Balance Sheet. Remember we make the balance sheet of the business and not of the owner.

No of Capital A/c in Partnership - In partnership since all the partners invest money so we have to prepare capital A/c of each partner separately. The debit and credit logic for preparing the capital A/s is same in partnership as it is in proprietorship i.e. Increase in capital is credit and decrease in capital is debited. Example if there are 2 partners then two capital A/c will be prepared. If there are 3 partners then 3 capital A/c will be prepared

Methods of preparing capital A/c in Partnership

There are two different methods for preparing partners capital A/c. Please see the diagram below and the explanation.

Fluctuating Capital A/c

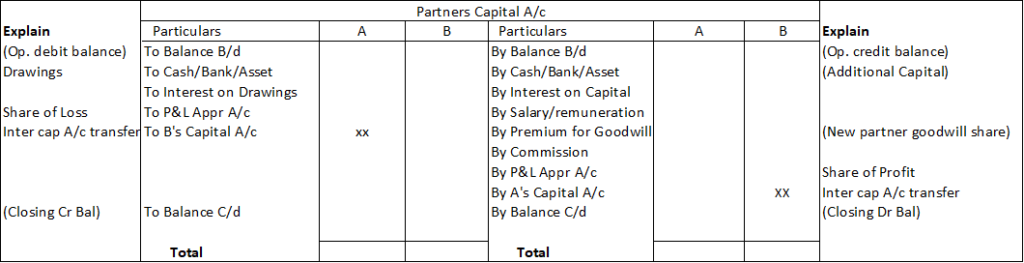

In this method only one capital A/c for each partner is prepared. All the transactions related to capital are entered in this single A/c. The format of capital A/c in this case assuming there are two partners along with the items in it is as follows

Items on Credit Side - All the transactions which increase partner capital are entered on credit side

Items on Debit Side - All the transactions which decrease partner capital are entered on debit side

Students should be conversant with the journal entries and how to do ledger posting of journal entries. If those concepts are clear then it will be very easy to understand why any transaction comes on either debit or credit side

Note : If the question is silent on which method to be followed then we assume that the fluctuating capital A/c method is followed.

| Pros | Cons |

| Single A/c maintained so easy to use | the capital invested by the partners cannot be known separately |

Fixed Capital A/c

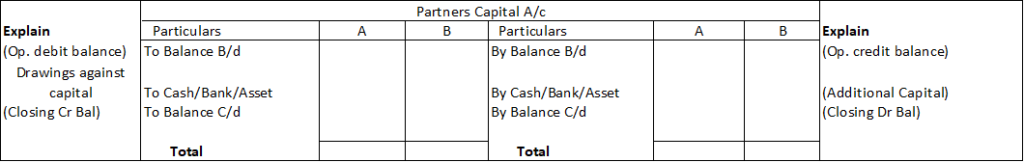

In this method two accounts are maintained for each partner. A) Capital A/c B) Current A/c

In the capital A/c, only the entries for introduction of capital and drawings against capital are made.

In the current A/c, all the rest of the entries except those in capital A/c above are entered.

This way the capital A/c will always show the amount of capital invested by any partner in the firm.

In this case both the capital A/c and Current A/c can have opening and closing balance

| Pros | Cons |

| Amount invested by partners can be known at any time | Comparatively difficult due to maintenance of two separate A/c |

Note : In case of fixed capital method , the partners current A/c can have both debit and credit balance. But the partner capital A/c will always have a credit balance

Difference between Fixed and Fluctuating method

| Basis | Fixed Capital A/c | Fluctuating Capital A/c |

| No of accounts maintained | Two i.e. Capital A/c and Current A/c | One i.e. Capital A/c |

| Frequency of change in Balance | Balance in capital A/c Changes only when new capital introduced or capital withdrawn | Balance in capital A/c changes after every transaction |

| Recording the transactions | Capital A/c – a) New capital introduced b) Drawings against capital Current A/c – a) Drawings against profit b) interest on drawings c) interest on capital d) salary e) commission f) share of profit/loss | Capital A/c – All the items affecting capital recorded here |

| Balance | Capital A/c will always show credit balance. Current A/c can have both Debit and Credit balance | Can show both credit and debit balance |