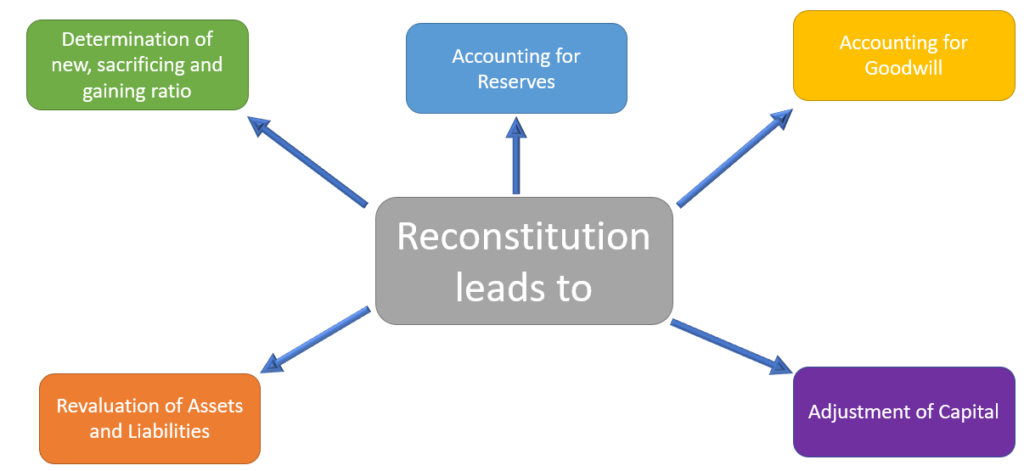

Five types of adjustments are required on the admission of a new partner in a partnership firm

- Determine new profit sharing ratio, Sacrificing ratio and gaining ratio

- Do the valuation of Goodwill and pass the necessary accounting entries

- Revaluation of assets and reassessment of liabilities

- Adjustments for Reserves, Accumulated Profits and Accumulated Losses

- Capital Adjustment

The above five types of adjustments are common for every type of reconstitution of partnership firm which includes:

- Change in Profit sharing ratio among partners

- Admission of a new partner

- Retirement of one or more partners

- Death of a partner

- Amalgamation of two or more partnership firms

Thus the above said 5 types of adjustments will be done in each case of reconstitution of partnership firm