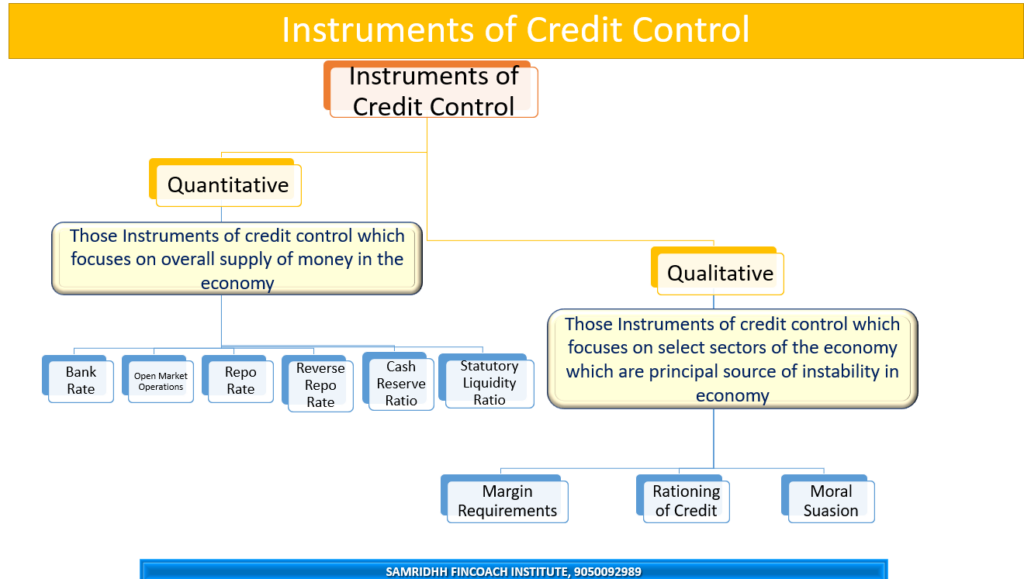

Quantitative and qualitative methods of credit control are two types of instruments used by the central bank of a country to regulate the money supply and interest rates in the economy. Here are some points to explain them:

- Quantitative methods affect the overall volume of credit in the banking system, without discriminating among different sectors or uses of credit. They are indirect and impersonal in nature, and aim to control inflation and money supply in the economy.

- Qualitative methods are also known as selective methods, because they target specific types of credit or borrowers, and influence the allocation or direction of credit in the economy. They are direct and personal in nature, and aim to prevent speculative or unproductive use of credit.

mindmap

root(Central Bank's Tools for Regulating Money Supply and Interest Rates)

(Quantitative Control Methods)

::icon(fa fa-balance-scale)

(Regulate overall credit volume)

(Used to control inflation and money supply)

(Indirect and impersonal in nature)

(Qualitative Control Methods)

::icon(fa fa-handshake-o)

(Selective methods)

(Specifically target certain types of credit or borrowers)

(More personal and direct in nature)

(Prevent speculative or unproductive uses of credit)

Quantitative Methods

- Bank rate : This is the interest rate at which the central bank lends money to commercial banks for a short period. By changing this rate, the central bank can influence the cost and availability of credit in the economy. A higher bank rate makes borrowing more expensive and reduces credit demand, while a lower bank rate makes borrowing cheaper and increases credit demand.

- Open market operations: These are the buying and selling of government securities by the central bank in the open market. By doing this, the central bank can inject or withdraw liquidity from the banking system. When the central bank buys securities, it pays money to the sellers and increases their money supply, which can be used for lending. When the central bank sells securities, it receives money from the buyers and reduces their money supply, which reduces their lending capacity.

- Cash reserve ratio: This is the percentage of deposits that commercial banks have to keep with the central bank as reserves. By changing this ratio, the central bank can affect the amount of money that commercial banks can lend or invest. A higher cash reserve ratio means that commercial banks have to keep more money with the central bank and have less money to lend or invest, while a lower cash reserve ratio means that commercial banks have to keep less money with the central bank and have more money to lend or invest.

- Repo rate: This is the interest rate at which the central bank lends money to commercial banks for a short period. By changing this rate, the central bank can influence the cost and availability of credit in the economy. A higher repo rate makes borrowing more expensive and reduces credit demand, while a lower repo rate makes borrowing cheaper and increases credit demand.

- Reverse repo rate: This is the interest rate which the central bank pays to commercial banks on their deposits. By changing this rate, the central bank can influence the supply and return of excess funds in the economy. A higher reverse repo rate makes depositing more attractive and reduces money supply, while a lower reverse repo rate makes depositing less attractive and increases money supply.

- Statutory Liquidity Ratio: This is the statutory liquidity ratio (SLR), which is the percentage of deposits that commercial banks have to maintain in liquid assets such as cash, gold, or government securities. By changing this ratio, the central bank can affect the amount of money that commercial banks can lend or invest. A higher SLR means that commercial banks have to keep more money in liquid assets and have less money to lend or invest, while a lower SLR means that commercial banks have to keep less money in liquid assets and have more money to lend or invest.

Qualitative Methods

- Margin requirements: These are the minimum percentage of security or collateral that commercial banks have to maintain against the loans. By changing these requirements, the central bank can discourage or encourage lending for specific purposes. A higher margin requirement means that commercial banks have to keep more security or collateral for a given loan amount, which reduces lending capacity, while a lower margin requirement means that commercial banks have to keep less security or collateral for a given loan amount, which increases their lending capacity.

- Regulation of consumer credit: This is the imposition of restrictions on the terms and conditions of loans for durable consumer goods. By doing this, the central bank can curb or stimulate consumer spending and demand. For example, the central bank can impose higher down payments, shorter repayment periods, or higher interest rates on loans for cars, refrigerators, etc., to reduce consumer credit and spending, or it can relax these conditions to increase consumer credit and spending.

- Control through directives: This is the issuance of orders or guidelines by the central bank to commercial banks regarding their lending policies. By doing this, the central bank can influence the quality and quantity of credit in the economy. For example, the central bank can direct commercial banks to lend more to priority sectors such as agriculture, small-scale industries, etc., or to limit their exposure to risky sectors such as real estate, stock market, etc.

- Credit rationing: This is the limitation of credit availability or credit ceiling for certain sectors or borrowers. By doing this, the central bank can prevent excessive or speculative use of credit in the economy. For example, the central bank can impose a maximum limit on the amount of credit that commercial banks can lend to a particular sector or borrower like housing sector, regardless of their demand or collateral.

- Moral suasion: These are the use of persuasion or appeal by the central bank to commercial banks to follow its policies. By doing this, the central bank can appeal to the sense of responsibility and cooperation of commercial banks in achieving the objectives of monetary policy. For example, the central bank can request commercial banks to voluntarily reduce their lending rates, increase their lending to priority sectors, etc., through speeches, press releases, meetings, etc.