What is Profit and Loss Appropriation A/c

Profit and Loss Appropriation Account is a nominal ledger account that records the allocation of net profit or loss among partners in a partnership firm. In a partnership, the profits or losses are distributed among partners according to the agreed terms as per the partnership agreement.

- Every partnership firm will

- first prepare the trading A/c to determine Gross Profit/Gross Loss,

- Then prepare Profit and Loss A/c to determine Net profit/Net loss,

- Then prepare the Profit and Loss Appropriation A/c to distribute the Net profit/Net Loss among the partners

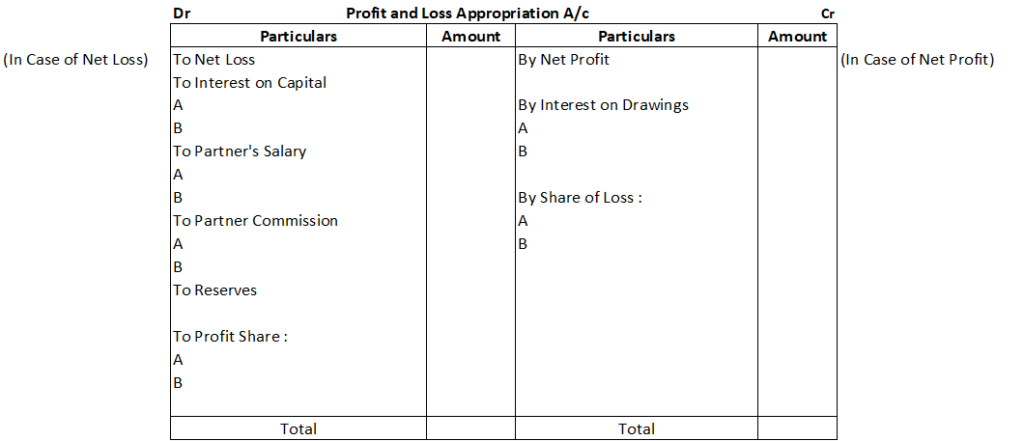

Items in Profit and Loss Appropriation A/c

A specimen Profit and Loss Appropriation A/s is given below which outlines the items that comes in it.

Net Profit or Net Loss

Only one of them will come depending upon whether the firm has earned Net profit or Net Loss

- Net Profit or Net Loss considered here should be

- After considering all the charges against profits

- Before considering any appropriation of profits

So if in question Net Profit is given before considering any charge against profits or after considering any appropriation of profits then we have to adjust the Net profit given in the question (for such charge or appropriation) before writing it in profit and Loss Appropriation A/c

Example - Suppose as per question Net profit after partner salary(Appropriation) but before rent payable to partner (Charge) is Rs 2 Lakhs. Partner Salary is Rs 50K and Rent Payable to Partner is Rs 20K.

In Such a case the Net profit written in Profit and loss Appropriation A/c will be (200000+50000-20000) = 230000

The above example just outlined 2 items for adjustment. In the question there can be other items of charge or appropriation. Students needs to adjust for other items similar to the way shown above before writing the Net profit/Loss in the profit and loss Appropriation A/c

Interest on Capital

Interest on Capital is an appropriation of profits in case of partnership. It is a way to compensate more the partners who have contributed more capital compared to other partners. Since it is an appropriation so it is neither a profit nor loss for the firm. For more information Click Here

Salary or Remuneration to Partners

The partners may receive salary or remuneration firm for managing the affairs of the firm. it is payable only if it part of partnership agreement. In the absence of any agreement for payment of salary or remuneration no salary or remuneration is payable to any partner. For more information Click Here

Commission to Partners

Partners may be allowed certain percentage commission on sales if it is mentioned in the agreement. In the absence of agreement no commission is payable to partners. For More Information Click Here

Transfer to Reserves

The firm to decide to transfer certain part of profits to reserves for future use and not distribute it to the partners. For information Click Here

Interest on Drawings

The partners may be charged interest on drawings against profits if it as per the agreement. No Interest on drawings will be charged in the absence of agreement. For more information CLick Here

Journal Entries for Profit and Loss Appropriation A/c

- In case of Net Profit

- P & L A/c Dr.

- To P & L Appr A/c

- In case of Net Loss

- P & L Appr A/c Dr..

- To P & L A/c

- Salary/commission/Interest on capital to partner

- P & L Appropriation A/c Dr..

- To Partner Capital/Current A/c

- Interest on Drawings

- Partner Capital/Current A/c Dr..

- To P & L Appr A/c

- Transfer to Reserves

- P & L Appr A/c Dr...

- To <Respective> Reserve A/c

- Transfer of profit to partner capital

- P & L Appr A/c Dr..

- To Partner Capital/Current A/c

- Transfer of loss to partner capital

- Partner Capital/Current A/c

- To P & L Appr A/c