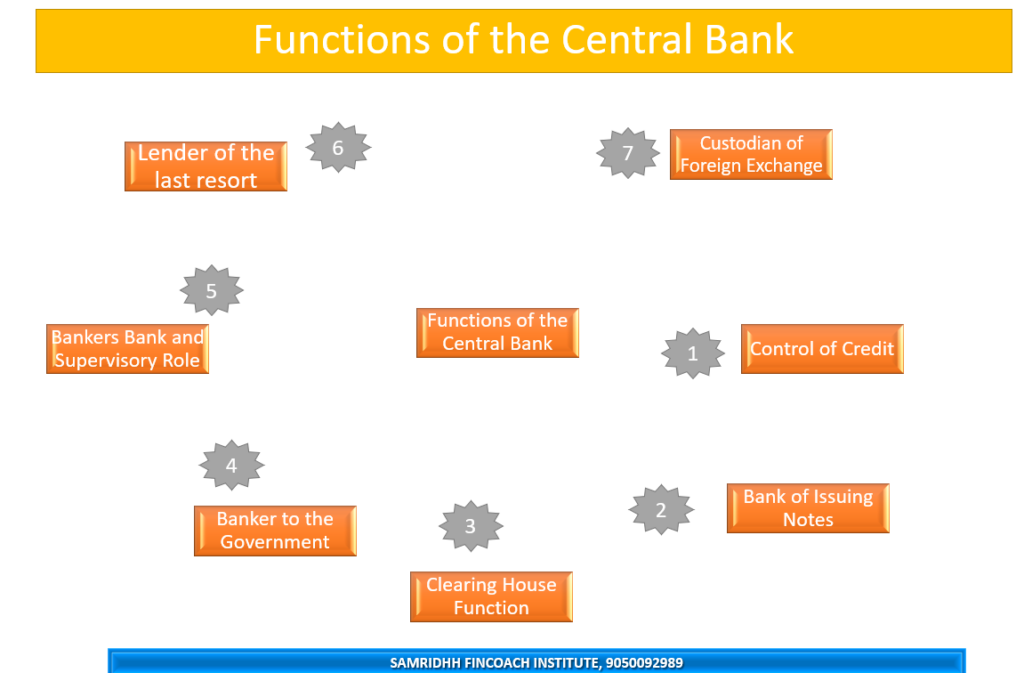

The central bank of a country is the institution that is responsible for managing the money supply, interest rates, and financial stability of the economy. The central bank of India is the Reserve Bank of India (RBI), which was established in 1935. The RBI performs various functions to achieve its objectives of economic growth, price stability, and financial inclusion. Some of the main functions of the RBI are:

- Bank of Issuing Notes: The RBI has the sole authority to issue and regulate the currency notes and coins in India. It also controls the circulation and distribution of currency among the public and banks. The RBI ensures that there is adequate supply of money in the economy to meet the demand and maintain its value.

- Banker and advisor to the government: The RBI acts as the banker and agent of the central and state governments. It accepts deposits from the government and lends money to them when needed. It also manages the public debt and treasury bills of the government. The RBI advises the government on various economic and financial matters, such as monetary policy, fiscal policy, exchange rate policy, etc.

- Custodian of cash reserves: The RBI requires all commercial banks to maintain a certain percentage of their deposits with it as cash reserves. This ratio is called the cash reserve ratio (CRR). By changing the CRR, the RBI can influence the amount of money that banks can lend or invest. A higher CRR means that banks have to keep more money with the RBI and have less money to lend or invest, while a lower CRR means that banks have to keep less money with the RBI and have more money to lend or invest.

- Custodian of foreign exchange reserves: The RBI is also responsible for maintaining and managing the foreign exchange reserves of the country. These reserves consist of foreign currencies, gold, special drawing rights (SDRs), and reserve tranche position (RTP) in the International Monetary Fund (IMF). The RBI uses these reserves to intervene in the foreign exchange market and stabilize the exchange rate of the rupee. The RBI also regulates the foreign exchange transactions of individuals and entities under the Foreign Exchange Management Act (FEMA).

- Lender of last resort: The RBI acts as the lender of last resort for commercial banks and other financial institutions. This means that when these institutions face a liquidity crisis or a solvency problem, they can borrow money from the RBI. The RBI provides this facility to prevent a financial panic or a bank run, which can disrupt the normal functioning of the economy.

- Clearing house for transfer and settlement: The RBI also acts as a clearing house for transfer and settlement of funds among banks and other financial institutions. It facilitates the clearing and settlement of cheques, drafts, electronic fund transfers, etc., through various systems such as National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS), Immediate Payment Service (IMPS), etc. The RBI ensures that these systems are safe, secure, efficient, and reliable.

- Controller of credit: The RBI is also responsible for controlling and regulating the credit creation by commercial banks and other financial institutions. It uses various instruments such as bank rate, repo rate, reverse repo rate, statutory liquidity ratio (SLR), open market operations (OMO), marginal standing facility (MSF), etc., to influence the availability and cost of credit in the economy. These instruments are collectively known as monetary policy tools. By using these tools, the RBI can either expand or contract the money supply and affect the interest rates, inflation, growth, etc., in the economy.

- Protector of depositors’ interests: The RBI is also concerned with protecting the interests of depositors who entrust their money with banks and other financial institutions. It does so by ensuring that these institutions follow certain prudential norms and regulations regarding capital adequacy, asset quality, liquidity, governance, etc. The RBI also supervises and inspects these institutions periodically to check their compliance and performance. The RBI also provides deposit insurance to depositors through the Deposit Insurance and Credit Guarantee Corporation (DICGC), which covers up to Rs. 5 lakh per depositor per bank.

Thus the RBI plays a vital role in maintaining the stability and growth of the Indian economy.