Government securities are debt instruments issued by a sovereign government to raise funds for various purposes, such as financing public projects, managing budget deficits, or paying off existing debts. From the investor perspective they are considered to be low-risk investments, as they are backed by the full faith and credit of the issuing government. Investors who buy government securities receive periodic interest payments depending on the type of Government security and the repayment of the principal amount at maturity.

Governments of various countries will issue their own securities for their financing needs. So its not that one or two country governments will issue securities but instead many countries will issue their own securities like USA, India, UK, Japan, China, Etc.

The investors in Government securities can either hold the Govt securities till maturity or sell them to other investors in the secondary markets. Though the secondary market may not have much liquidity in many countries. The investors in Government securities should keep themselves updated about the political and economic situation of the country in whose securities they have invested to keep themselves updated about the default risk by that Government.

There are different types of government securities, depending on the issuer, the maturity, and the interest rate. Some of the most common ones are:

- Treasury bills (T-bills): These are short-term securities with maturities ranging from a few days to 52 weeks. They are sold at a discount to their face value and do not pay any interest. The difference between the purchase price and the face value is the investor’s return.

- Treasury notes (T-notes): These are medium-term securities with maturities from 2 to 10 years. They pay a fixed interest rate every six months and repay the principal amount at maturity.

- Treasury bonds (T-bonds): These are long-term securities with maturities from 10 to 30 years. They also pay a fixed interest rate every six months and repay the principal amount at maturity.

- Cash management bills (CMBs): These are short-term securities issued by the government to meet its temporary cash needs. They have irregular maturities and are sold at a discount to their face value.

- Dated G-Secs: These are fixed-interest-bearing securities issued by the government of India for maturities ranging from 5 to 40 years. They pay interest semi-annually and repay the principal amount at maturity.

- State development loans (SDLs): These are securities issued by the state governments of India to finance their development projects. They have maturities from 2 to 10 years and pay interest semi-annually.

Government securities can be bought and sold in the primary market, where they are issued by the government, or in the secondary market, where they are traded among investors

In India retail investors can also purchase Government securities by opening an account with RBI retail direct. They have to submit their basic identification documents with RBI. After opening the account the process of investing in India Government securities is very easy. Investors can also invest in various state Government securities through the RBI retail direct account

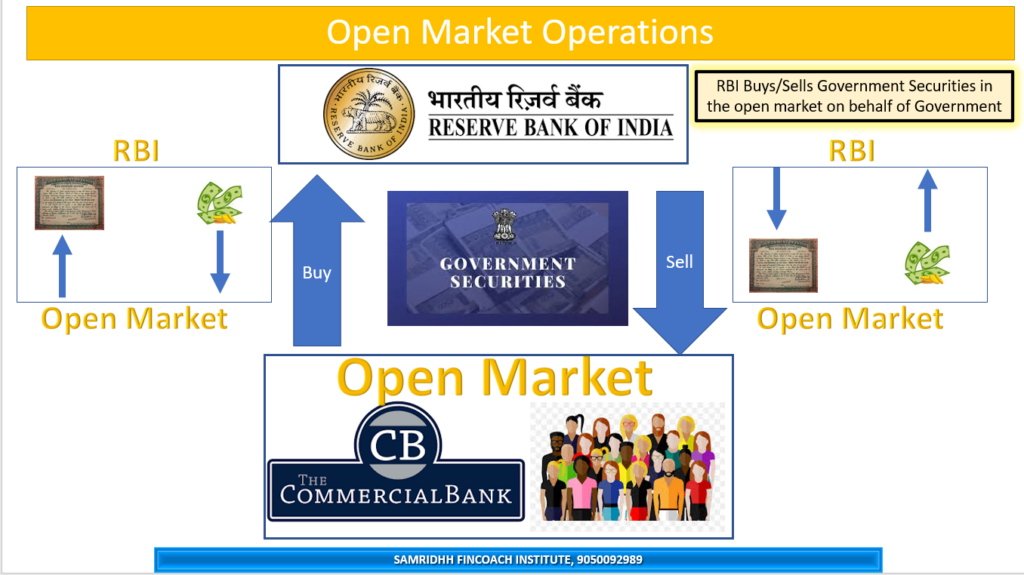

Apart from being a source of finance for the Government, securities also serve another purpose. The Central bank of the country (RBI in case of India) uses them as an instrument for controlling credit and money supply. The central bank resort to open market operations for this purpose. When central bank want to increase money supply in the economy then they buy Government securities from the open market and when they want to reduce money supply in the economy then they sell Government securities. The money supply in the economy in turn have a direct impact on the inflation levels in the country

The flow of Open market operations is shown in the below diagram

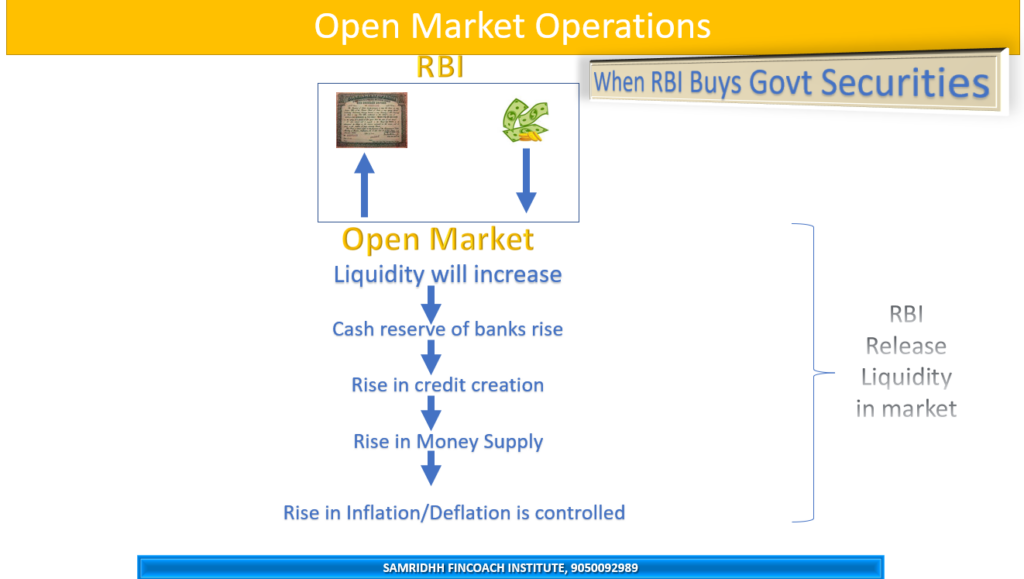

When RBI Buys Government securities from the open market is depicted below :

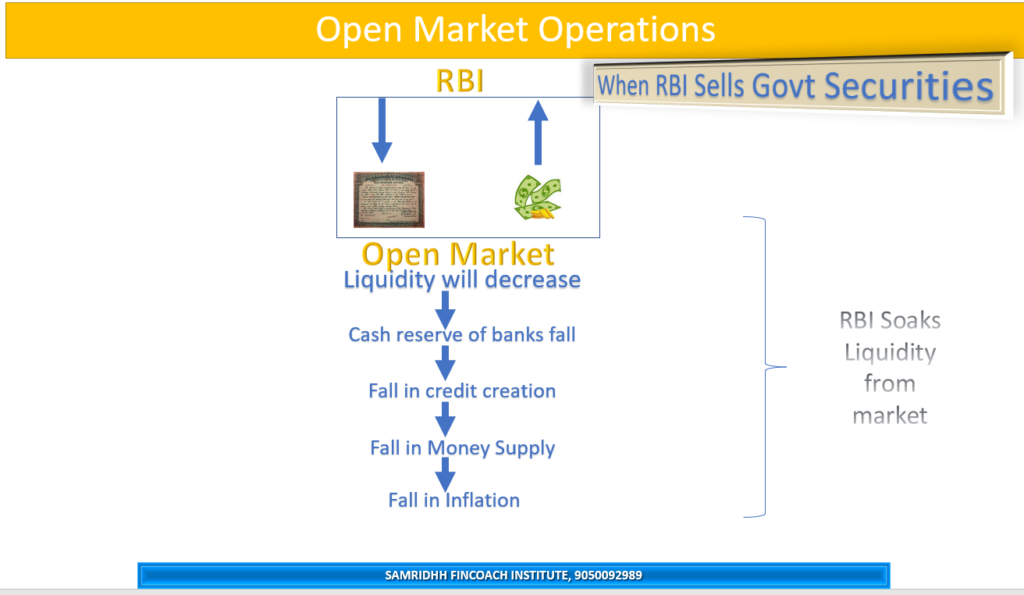

When RBI sells Government securities in the open market is depicted below :