Preference shares can be broadly classified based on following four criteria :

- Based on right to receive dividend

- Based on participation in surplus profits

- Based on convertibility into equity shares

- Based on terms of redemption

Based on right to receive dividend

There can be two kinds of preference shares : 1) Cumulative Preference Shares 2) Non-Cumulative Preference shares

Cumulative preference shares are those shares which has the right to receive arreas of dividend. Suppose a company cannot pay any dividend to preference shares in the year 2021 due to inadequate profits or any other reason. Now in next year 2022 if the company is going to pay dividend then first it has to pay the dividend on cumulative preference shares for both years 2021 and 2022 before any dividend can be paid to equity shareholders. Thus, cumulative preference shares does not loose anything in case company does not pay dividend in any year. The unpaid dividend will keep on accumulating until the company pays the arrears.

On the other hand, non cumulative preference shares does not carry any such accumulation rights. In case dividend is not paid in a particular year by the. Company then the dividend for such a year will lapse and will not be paid in the subsequent year.

So now you can choose which type of shares you would like to invest your money.

Based on participation in surplus profits

There can be two kinds of preference shares : 1) Participating Preference Shares 2) Non-Participating Preference shares

Participating Preference shares are shares which can participate in the surplus profit after a fixed amount of dividend is paid to the equity shareholders. So firstly, dividend will be paid to preference shares at the rate fixed, then a fixed rate of dividend will be paid to the equity shares. And then any surplus profits will again be divided between both the participating preference shares and equity shares.

It is to be noted that usually the rate of dividend on equity shares is not fixed. But if the company has issued participating preference shares, then the rate of dividend on equity shares will also be fixed.

On the other hand, non-participating preference shares are those which does not carry any such right of participating in surplus profits. They only carry a right for a fix dividend.

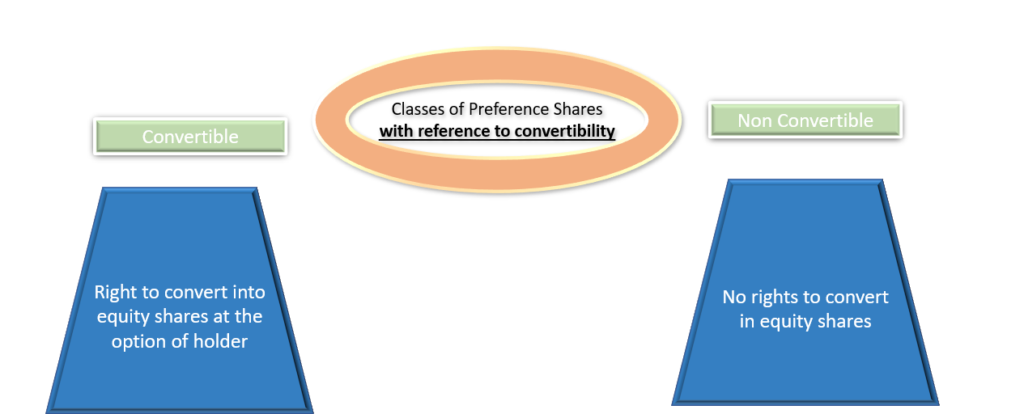

Based on Convertibility

Convertible preference shares are those shares which can be converted into equity shares after a fixed period. The right to convert is an option given to shareholder,and is not a necessity.

On the other hand, non-convertible preference shares cannot be converted into equity shares

Based on Redemption

Redeemable preference shares are those shares where the company makes the repayment after a certain specified period. This. cannot be greater than 20 years from the date of issue. The repayment of preference shares is termed as redemption.

On the other hand, irredeemable preference shares are those which are not repaid during the life time of the company. Such shares can be repaid only at the time of winding up of the company.

It is to be noted that as per companies act, irredeemable preference shares cannot be issued.