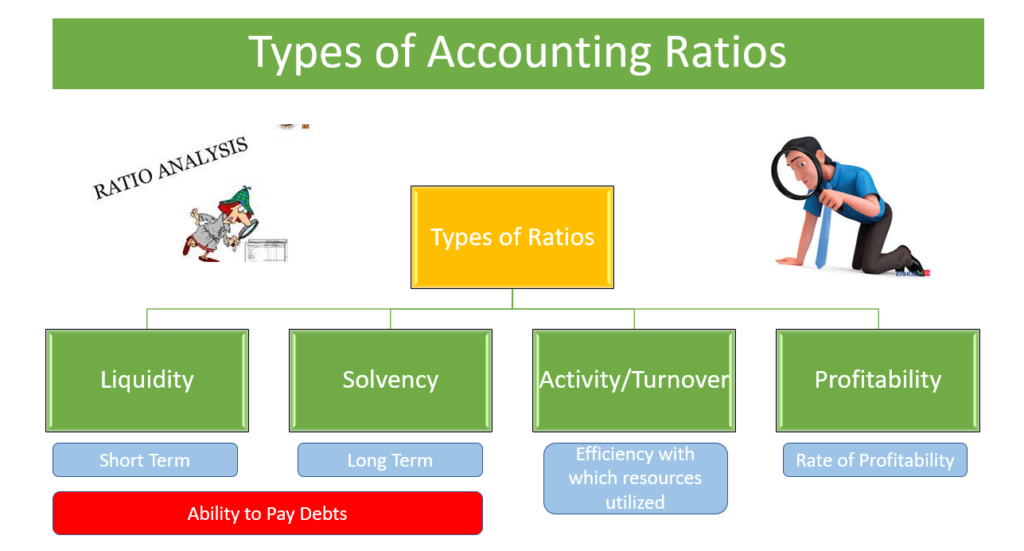

There are many different types of accounting ratios, including:

- Profitability ratios: These ratios measure a company's ability to generate profits and include ratios such as the net profit margin, gross profit ratio, operating ratio, operating profit ratio, and return on investment.

- Liquidity ratios: These ratios measure a company's ability to meet its short-term financial obligations and include ratios such as the current ratio and the quick ratio.

- Solvency ratios: These ratios measure a company's ability to meet its long-term financial obligations and include ratios such as the debt-to-equity ratio and the interest coverage ratio.

- Activity ratio or Turnover ratios or Efficiency ratios: These ratios measure a company's ability to use its resources efficiently and include ratios such as the inventory turnover ratio and the asset turnover ratio.

- Investor ratios: These ratios measure the returns that investors can expect from a company and include ratios such as the price-to-earnings ratio (P/E ratio) and the dividend yield. (Please note that these ratios are not part of CBSE Board Class 12 syllabus)

What are Short term funds and Long term funds

Before discussing different types of ratios, first we need to understand the difference between short term funds and long-term funds. Suppose you take a big amount housing loan from bank and purchase a house. Does having a big amount housing loan ensures that you can buy your daily food? The answer is No. The loan amount is invested in the house.

Consider another scenario. You have sufficient money to buy your food and clothes for next 3 months. Can you buy a house to live in from that money. Again, the answer is No.

This brings us to the fact that the funds we have are long term funds and short-term funds. Long term funds are spent on purchasing things useful in long term and short-term funds are spent on purchasing things for short term. Similarly, the business also has short term funds and long-term funds. While analyzing any company's health, we need to separately assess the short-term funds availability or solvency and long-term funds availability or solvency. 'Liquidity ratios' measure short term solvency and 'Solvency ratios' measure long term solvency.

Liquidity Ratios

Liquidity ratios are financial ratios that measure a company's ability to meet its short-term financial obligations. These ratios are used to assess the short-term financial stability of a business and its ability to pay its bills and debts as they come due.

There are several liquidity ratios that are commonly used, including:

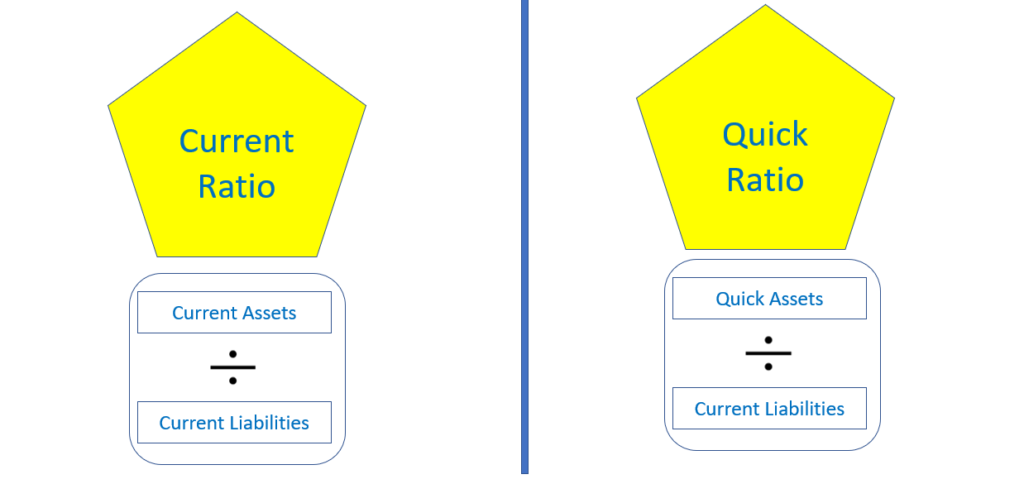

- Current ratio: The current ratio is calculated by dividing a company's current assets by its current liabilities. It measures the ability of a company to pay its short-term obligations with its most liquid assets.

- Quick ratio: The quick ratio, also known as the acid-test ratio or Liquid Ratio, is calculated by dividing a company's quick assets (such as cash and cash equivalents, and accounts receivable) by its current liabilities. It measures the ability of a company to pay its short-term obligations with its most liquid assets.

- Quick Assets = Current Assets - Inventory - Prepaid Expenses

- Cash ratio: The cash ratio is calculated by dividing a company's cash and cash equivalents by its current liabilities. It measures the ability of a company to pay its short-term obligations with its most liquid assets, excluding accounts receivable. (Please note that this ratio is not part of CBSE Board Class 12 syllabus and is less frequently used)

Liquidity ratios are important indicators of a company's short-term financial stability and its ability to meet its financial obligations. It is important to consider these ratios in conjunction with other financial information and industry benchmarks when evaluating a company's financial position.

Solvency Ratios

Solvency ratios are financial ratios that measure a company's ability to pay its long-term debts and obligations. These ratios are used to assess the financial health of a company and to determine its ability to meet its financial obligations in the long run.

There are several different solvency ratios, including:

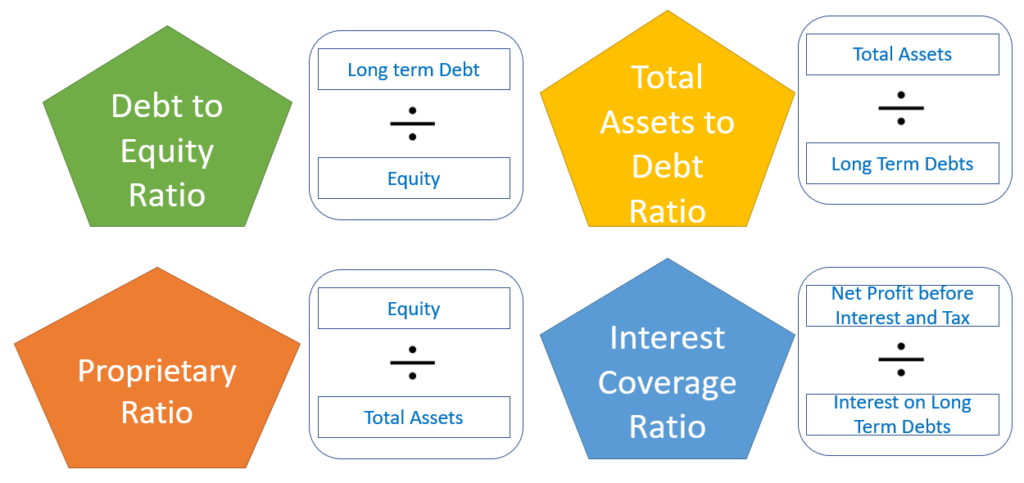

- Debt-to-equity ratio: This ratio compares a company's total debt to its total equity. It indicates the proportion of a company's financing that comes from debt versus equity. A high debt-to-equity ratio may indicate that a company is heavily reliant on borrowing, which could be a red flag for investors.

- Total Assets to Debt Ratio: The total assets to debt ratio is a financial ratio that measures a company's financial leverage. It is calculated by dividing the company's total assets by its total debt. This ratio indicates the proportion of a company's assets that are financed through debt.

- Proprietary Ratio: The proprietary ratio indicates the proportion of a company's assets that are financed through equity rather than debt. It is calculated by dividing the company's equity by its total assets.

- Interest coverage ratio: This ratio measures a company's ability to make its interest payments on its debt. It is calculated by dividing the company's earnings before interest and taxes (EBIT) by its interest expense. A low interest coverage ratio may indicate that a company is struggling to generate enough income to cover its interest payments.

- Debt service coverage ratio: This ratio measures a company's ability to pay its debt principal and interest. It is calculated by dividing the company's net operating income by its total debt service (principal and interest payments). A low debt service coverage ratio may indicate that a company is having difficulty making its debt payments. (Please note that this ratio is not part of CBSE Board Class 12 syllabus)

- Cash flow to debt ratio: This ratio compares a company's cash flow to its total debt. It indicates the company's ability to pay off its debt using its cash flow. A high cash flow to debt ratio may indicate that a company is in good financial health, as it has a strong ability to pay off its debts. (Please note that this ratio is not part of CBSE Board Class 12 syllabus and is less frequently used)

Overall, solvency ratios are important indicators of a company's financial health and ability to meet its long-term financial obligations. They can be useful for investors, creditors, and other stakeholders when evaluating a company's financial stability.

Activity or Turnover Ratios

Turnover ratios are financial ratios that measure the efficiency with which a company is using its assets and generating sales. These ratios are used to assess the performance and efficiency of a company's operations and to determine how effectively it is utilizing its resources.

There are several different turnover ratios, including:

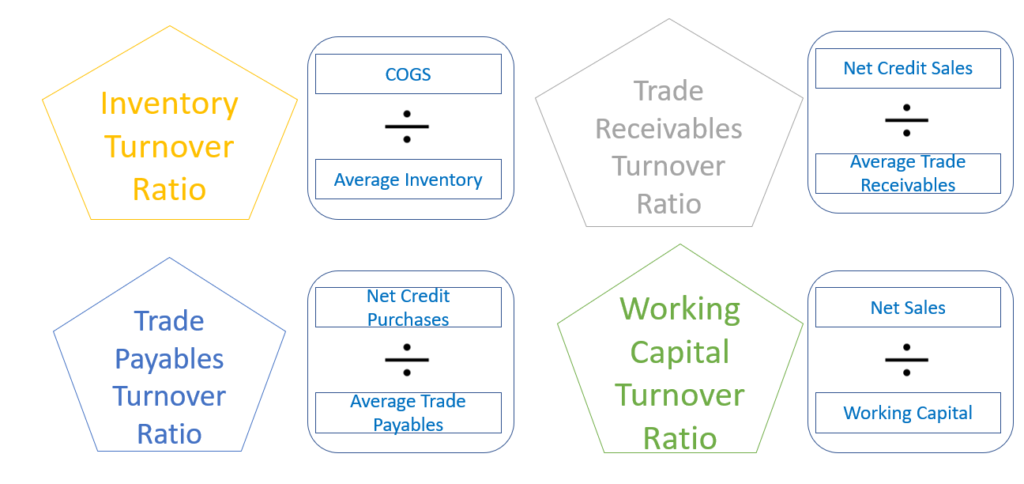

- Inventory turnover ratio: This ratio measures how quickly a company is selling its inventory. It is calculated by dividing the company's cost of goods sold by its average inventory. A high inventory turnover ratio may indicate that a company is efficiently managing its inventory and generating sales, while a low ratio may indicate that the company is holding onto its inventory for a long time and not generating enough sales.

- Trade Receivables turnover ratio: This ratio measures how quickly a company is collecting payment for its sales. It is calculated by dividing the company's annual credit sales by its average accounts receivable. A high receivables turnover ratio may indicate that a company is effectively managing its accounts receivable and collecting payment in a timely manner, while a low ratio may indicate that the company is having difficulty collecting payment from its customers.

- Trade Payables Turnover Ratio: Trade payables turnover ratio is a financial ratio that measures the efficiency with which a company is paying its trade payables. Trade payables are amounts that a company owes to its suppliers for goods or services that it has received on credit. It is calculated by dividing the company's Net Credit Purchases by its average trade payables. It indicates how many times a company's trade payables are turned over or paid during a given period, such as a year. A high trade payables turnover ratio may indicate that a company is efficiently managing its trade payables and paying its suppliers in a timely manner, while a low ratio may indicate that the company is having difficulty paying its trade payables.

- Working Capital Turnover Ratio: This measures the efficiency with which a company is using its working capital. Working capital is the excess of a company's current assets over its current liabilities. It represents the funds that a company has available to meet its short-term operating needs, such as paying bills and employees. The working capital turnover ratio is calculated by dividing the company's Net sales (or Revenue from Operations) by its average working capital. It indicates how many times a company's working capital is turned over or used to generate sales during a given period, such as a year. A high working capital turnover ratio may indicate that a company is efficiently using its working capital to generate sales, while a low ratio may indicate that the company is not effectively utilizing its working capital.

- Fixed assets turnover ratio: This ratio measures how efficiently a company is using its fixed assets, such as buildings, equipment, and machinery. It is calculated by dividing the company's Net sales by its total fixed assets. A high fixed assets turnover ratio may indicate that a company is efficiently using its fixed assets to generate sales, while a low ratio may indicate that the company is underutilizing its assets. (Please note that these ratios are not part of CBSE Board Class 12 syllabus)

Overall, turnover ratios are useful indicators of a company's efficiency and performance. They can be used by investors, creditors, and other stakeholders when evaluating a company's financial health and operations.

Profitability Ratios

Profitability ratios are financial ratios that measure a company's ability to generate profits. These ratios are used to assess the financial performance of a company and to determine its profitability compared to its competitors.

There are several different profitability ratios, including:

- Gross profit ratio: This ratio measures the profitability of a company's products or services before taking into account its operating expenses. It is calculated by dividing the company's gross profit by its total revenue from operations. A high gross profit ratio may indicate that a company is able to charge high prices for its products or has a cost advantage over its competitors.

- Operating Ratio: Operating ratio is a financial ratio that measures a company's operating cost as a percentage of its net sales. It is calculated by dividing the company's operating cost by its net sales. The operating ratio indicates the efficiency of a company's operations and the extent to which its sales are covering its operating cost. A low operating ratio may indicate that a company is efficiently managing its operations and generating a high level of profits relative to its sales. On the other hand, a high operating ratio may indicate that a company is struggling to generate profits and is spending a large proportion of its sales on operating cost.

- Operating profit ratio: This ratio measures the profitability of a company's operations after taking into account its operating cost, but before considering non operating expenses and non operating income. It is calculated by dividing the company's operating profit by its total revenue from operations. A high operating profit ratio may indicate that a company is able to efficiently run its operations and generate profits.

- Net profit ratio: This ratio measures the overall profitability of a company after taking into account all expenses, including non operating expenses and non operating income. It is calculated by dividing the company's net profit by its total revenue from operations. A high net profit ratio may indicate that a company is generating a high level of profits relative to its sales.

Overall, profitability ratios are important indicators of a company's financial performance and ability to generate profits. They can be useful for investors, creditors, and other stakeholders when evaluating a company's financial health and potential for growth.